20 Best Suggestions For Picking AI Stock Trading Sites

Top 10 Tips To Evaluate The User Experience And Interface Of Ai Stock Trading PlatformsThe User Interface (UI) and User Experiences (UX) within AI trading platforms that forecast or analyze the price of stocks play an important part in ensuring efficiency and satisfaction. A poorly designed interface can make it difficult to make decisions, even if the base AI models are reliable. Here are the top 10 guidelines for evaluating the UX/UI of these platforms:

1. Evaluation of the intuitiveness and ease of use

Navigation Facilitate the platform to use using clearly defined menus, buttons and workflows.

Learning curve: Identify the speed at which new users learn and operate a platform without extensive training.

Make sure you have consistent designs (e.g. color schemes and buttons) across all platforms.

2. Look for customizability

Dashboard customization: Check whether users are able to customize dashboards to display relevant data such as charts, metrics, and charts.

Layout flexibility: Ensure the platform allows you to reorder widgets, charts and tables.

Themes and preferences: Check if the platform offers dark/light options or other preferences for visuals.

3. Visualize data using the Assess Tool

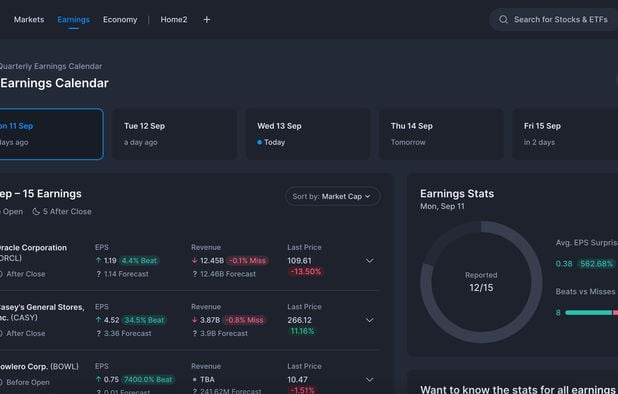

Chart quality - Ensure that the platform includes high-resolution interactive charts (e.g. candlestick charts and line charts) that include zooming, panning, and other functions.

Visual clarity: Make sure that the information is clearly presented, with proper labels, legends, tooltips and more.

Real-time updates: Check if visualizations are updated in real-time to reflect market fluctuations.

4. Test Speed and Responsiveness

Time to load: Make sure your platform loads fast regardless of handling huge datasets or complex calculations.

Real-time Performance: Find out if your platform is able to process data feeds with no lag.

Cross-device compatibility : Make sure that your device is compatible with the platform (desktops, mobiles, tablets).

5. Examine Accessibility

Go through the mobile app to determine if the app has all of the features that you require for on-the go trading.

Keyboard shortcuts. Check to see if the platform provides keyboard shortcuts to power users.

Accessibility features - Check that the platform is in compliance with accessibility standards.

6. You can search and filter your results.

Search performance: Ensure that the platform is able to allow users a quick search of stocks, indices or any other assets.

Advanced filters: Find out if the user can apply filters to produce results that are more specific (e.g. by sector, capitalization, performance metrics).

Saved search: Check if the platform lets users save frequently used searches and filters.

7. Check for Alerts or Notifications

Customizable notifications: Users can create notifications that are tailored to specific conditions.

Notification delivery: Determine that alerts are being delivered through different channels (e.g. SMS, email, or in-app notifications).

Timeliness - Check whether alerts are sent out quickly and precisely.

8. Evaluate Integration with Other Tools

Integration of brokers is crucial to ensure a smooth execution of trades.

API access: Find out if advanced users can access the API to develop their own custom software or workflows.

Third-party integrations : Find out if the platform allows integration with other tools, such as Excel, Google Sheets or trading bots.

9. Examine the Help and Support Features

Tutorials for onboarding: Find out whether the platform offers tutorials or walkthroughs to new users.

Help center: Ensure that the platform offers a comprehensive knowledge base or a help center.

Customer support: Verify whether the platform has prompt customer service (e.g., live chat, email, telephone).

10. Test Overall User Experience

User feedback Reviews and testimonials from research to gauge the overall satisfaction level with the UI/UX.

Trial period for free: Test the platform for free and evaluate its usability.

What is the platform's approach to handling edges and errors?

Bonus Tips:

Aesthetics. While function is a key element, an attractive design can enhance your overall experience.

Performance under stress: Test the platform during volatile market conditions to make sure that it is stable and responsive.

Check whether the platform has an active user community in which users can exchange feedback and offer tips.

With these suggestions You can easily evaluate the UI/UX of AI trading platforms for stock prediction or analysis and ensure that they are easy to use, efficient and compatible with your needs in trading. The UI/UX of a trading platform can have a significant impact on the ability of you to make informed trades and make the right choices. View the best inciteai.com AI stock app for site advice including investment ai, best AI stock trading bot free, ai investing, ai trading, AI stock picker, ai investment app, ai trading, ai investing, ai for investing, best ai for trading and more.

Top 10 Ways To Evaluate The Transparency Of AI stock Trading Platforms

Transparency can be a key factor when making a decision about AI trading and stock predictions platforms. It allows the user to be confident in the operation of a platform, understand how decisions were made and to verify the accuracy of their predictions. Here are the top 10 tips to determine the level of transparency that these platforms offer.

1. AI Models: A Simple Explanation

TIP: Make sure that the platform is clear about the AI models and algorithms used to make predictions.

Why? Understanding the underlying technologies can help users determine the reliability of their products.

2. Sources of Data Disclosure

TIP: Determine if the platform is transparent about the sources of data it relies on (e.g. historical stock data, news, social media).

What is the benefit of knowing the sources of data will help you ensure that the platform has trustworthy and accurate data sources.

3. Performance Metrics and Backtesting Results

TIP: Always search for transparent reporting on performance metrics, such as accuracy rates and ROI, as well as backtesting results.

This will enable users to assess the efficiency of the platform and its historical performance.

4. Updates and notifications in real-time

Tips. Find out if your platform provides real-time data and notifications regarding trades or changes to the system, like trading forecasts.

Why: Real time transparency ensures that users are informed of the most critical actions.

5. Open Communication About Limitations

TIP: Check if your platform clarifies the limitations and risks of the trading strategies it employs and the forecasts it makes.

The reason: Recognizing limits increases trust and helps you make better decisions.

6. Users can access the raw data

Tips: Check if users have access to raw data as well as intermediate results that are used by AI models.

Why? access to raw data enables users to conduct their own analysis and validate their predictions.

7. Transparency regarding fees and charges

Tips: Make sure the website clearly lists all fees, subscription costs and any hidden costs.

The reason: Transparent pricing avoids cost-insane surprises and helps build confidence.

8. Regular reporting and audits

Check if your platform is routinely inspected by third party auditors or if it provides reports on its performance.

Independent verification is important because it enhances the credibility of the process and ensures accountability.

9. The ability to explain predictions

Tips: Find out on how the platform makes predictions or specific recommendations (e.g. features importance or decision trees).

Why: Explainability helps users understand the reasoning of AI-driven decisions.

10. Feedback and Support Channels for Users

TIP: Determine whether there are clear channels of communication that allow users to give feedback and receive support. Also, consider whether it is clear in its response to concerns that users have raised.

What is the reason? It shows an interest in the transparency of users and their satisfaction.

Bonus Tips - Regulatory Compliance

Check that the platform meets all financial regulations. It should also disclose the status of its compliance. This increases transparency and credibility.

You can evaluate these elements to determine whether the AI stock trading and prediction system is transparent, and make an informed choice. This will help you to build your confidence and confidence in the capabilities of the platform. See the most popular stocks ai for website tips including stock predictor, best stock prediction website, investing with ai, stock predictor, AI stock investing, how to use ai for stock trading, AI stock trader, ai options trading, AI stock investing, AI stock investing and more.